Vehicle Property Damage Lawyers: Top 5 Essential Tips

Steering Through Legalities: Vehicle Property Damage Lawyers

Navigating the aftermath of a vehicle accident can be daunting, especially when you’re faced with property damage claims and complex insurance policies. Vehicle property damage lawyers play a crucial role in ensuring that your claims are handled efficiently and you receive the compensation you deserve.

- Property Damage Claims: These claims involve the financial recovery for damages to your vehicle following an accident.

- Insurance Coverage: It’s essential to understand what your policy covers, including any exclusions or limits on damages like wind or flood.

- Legal Assistance: Hiring a lawyer can streamline the claims process, combating lowball offers and ensuring fair treatment by insurance companies.

In Florida, property owners frequently face challenges with underpaid or denied claims, adding to the frustration of handling vehicle damage. Understanding your rights and seeking timely legal assistance is vital to steer this process smoothly.

Understanding Vehicle Property Damage Claims

When your vehicle is damaged, understanding the type of claim you need to file is crucial. Let’s break down the basics of vehicle property damage claims.

Types of Claims

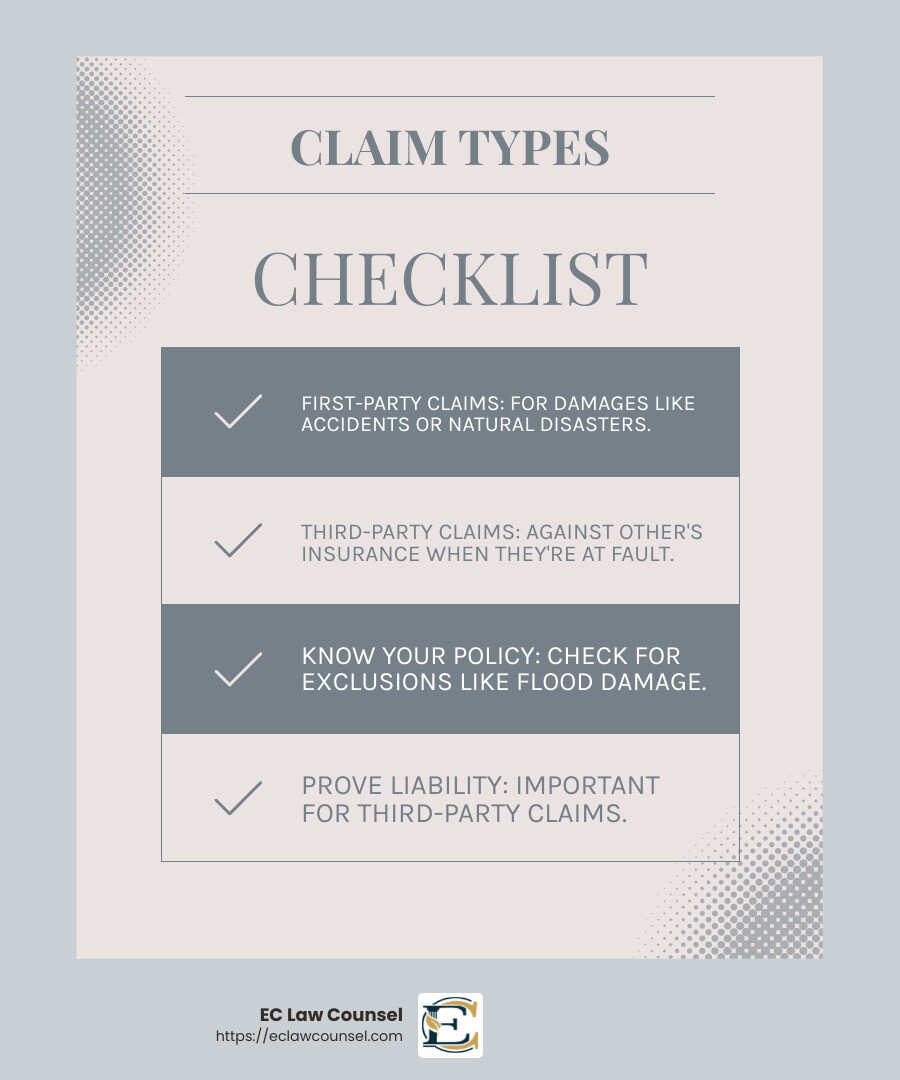

Vehicle property damage claims generally fall into two categories: first-party claims and third-party claims. Each type has its own process and requirements.

- First-Party Claims: These are claims you file with your own insurance provider. If your car is damaged due to an accident, vandalism, or natural disaster, you reach out to your insurer for compensation. It’s important to know what your policy covers, as some policies may exclude specific damages like floods or wind damage.

- Third-Party Claims: These claims are made against another person’s insurance when they are at fault for the damage. For example, if someone hits your car, you would file a third-party claim with their insurance company. This type of claim often involves proving the other party’s liability, which can be complex.

First-Party Claims: Your Safety Net

First-party claims are your go-to when your own insurance policy is involved. These claims can cover a variety of damages, including collision damage, theft, or vandalism. Your insurance company will assess the damage and determine the payout based on your policy terms.

Third-Party Claims: Holding Others Accountable

Third-party claims require you to pursue the at-fault party’s insurance. This can be tricky, as insurance companies often dispute liability or the extent of the damage. Having a vehicle property damage lawyer can help steer these disputes and ensure you get fair compensation.

In both cases, documentation is key. Keep detailed records of the accident, including photos, repair estimates, and any communication with insurance companies. This will support your claim and help in negotiations.

Understanding the nuances of these claims can make a significant difference in the outcome of your case. With the right approach, you can steer through the complexities of vehicle property damage claims effectively.

The Role of Vehicle Property Damage Lawyers

When dealing with the aftermath of a vehicle accident, vehicle property damage lawyers can be invaluable. They guide you through the legal maze, negotiate with insurance companies, and streamline the claim process. Here’s how they make a difference:

Legal Guidance

Navigating a property damage claim can be daunting. Lawyers offer crucial legal guidance, helping you understand your rights and responsibilities. They clarify what your insurance policy covers and what you can expect from the claims process. This knowledge empowers you to make informed decisions.

Insurance Negotiations

Insurance companies often try to minimize payouts. They may use tactics like old damage deductions or improper condition adjustments to lowball your claim. A lawyer acts as your advocate, ensuring the insurance company treats you fairly.

- Fair Valuation: Lawyers make sure you receive the full and accurate value of your damaged property. They counter low offers with evidence-backed arguments.

- Rental and Replacement Coverage: They also help you explore your policy for rental car coverage or replacement of essential items, like laptops needed for work.

Claim Process

From filing to settlement, the claim process involves several steps. Lawyers handle the paperwork, gather evidence, and communicate with insurance adjusters. This allows you to focus on recovery, not red tape.

- Documentation: They collect necessary documentation, like accident reports and repair estimates, to build a strong case.

- Simultaneous Claims: If there are also injury claims, lawyers can manage both simultaneously, ensuring no aspect is overlooked.

Having a vehicle property damage lawyer on your side simplifies these complex processes. They handle the heavy lifting, so you don’t have to steer it alone. This support can significantly impact the speed and success of your claim.

Common Types of Vehicle Property Damage

When it comes to vehicle property damage, there are several common scenarios that car owners might face. Understanding these can help you know what to expect and how to handle each situation.

Collision Damage

Collision damage is perhaps the most frequent type of vehicle property damage. It happens when vehicles crash into each other or an object, like a tree or a pole. Whether it’s a minor fender bender or a major crash, collision damage can lead to costly repairs. Insurance companies may try to dispute the extent of damage or blame you for part of the accident to reduce the payout. This is where having a vehicle property damage lawyer can help ensure fair compensation.

Storm Damage

Storms can be unpredictable and damaging. High winds, hail, or falling branches during a storm can wreak havoc on your vehicle. In Massachusetts, for instance, wind damage is common during severe weather events, as highlighted in the research. If your insurance policy doesn’t cover storm damage, you might need to purchase additional coverage. Be sure to review your policy carefully, as some insurers may try to exclude this type of damage.

Fire Damage

Fire can cause extensive damage to a vehicle, often leading to a total loss. Whether the fire stems from an accident or an external source, the aftermath can be overwhelming. Fire damage not only affects the vehicle’s structure but can also destroy personal items inside. Insurance claims for fire damage can be challenging, as insurers may question the cause of the fire or the value of the vehicle. A lawyer can help you gather evidence and document losses to strengthen your claim.

Water Damage

Water damage isn’t just a problem for homes; it can affect vehicles too. Flooding or heavy rain can cause significant harm to a car’s electrical systems and interior. In places like Florida, water damage is a common cause of insurance claims due to the frequent storms and floods. If water damage isn’t addressed quickly, it can lead to mold and further deterioration. Make sure to report water damage promptly and provide detailed documentation to your insurer.

Understanding these common types of vehicle property damage can prepare you for the unexpected. Whether it’s a collision, storm, fire, or water damage, knowing the potential pitfalls and how to steer them with the help of a vehicle property damage lawyer can make a significant difference in the outcome of your claim.

How to File a Vehicle Property Damage Claim

Filing a vehicle property damage claim can feel overwhelming, but breaking it down into simple steps can help. Here’s what you need to know to get started.

Documentation

Start by making a complete list of damaged property. Don’t just focus on the obvious, like your car. Include any personal items that were damaged, such as a cracked phone screen or broken glasses.

Take photographs of the damage. Capture images of your vehicle and any other property affected. Pictures can provide valuable evidence when negotiating with insurance companies.

Gather documentation like accident or police reports. These documents provide details about the incident and can support your claim.

Evidence Gathering

Collect repair or replacement estimates. Visit repair shops to get detailed estimates of the damage. If you’ve already paid for repairs, keep the receipts to claim reimbursement.

For replacement costs, look for advertisements or listings of similar vehicles. This can help establish a fair market value for your damaged vehicle.

Insurance Communication

Before contacting your insurer, review your policy to understand what is covered. Some policies might include additional benefits, like rental car coverage, which can be helpful during repairs.

When you contact your insurance company, be prepared to provide all the documentation and evidence you’ve gathered. This will help speed up the process and ensure you get a fair assessment.

If you’re unsure about how to proceed, consider consulting a vehicle property damage lawyer. They can guide you through the process, handle negotiations, and ensure the insurance company treats you fairly.

The goal is to be fully compensated for your losses. By being thorough with your documentation and evidence, and by effectively communicating with your insurer, you can steer the claims process with confidence.

Frequently Asked Questions about Vehicle Property Damage Lawyers

What type of lawyer deals with property damage?

When dealing with property damage, property damage lawyers are your go-to professionals. They focus on helping individuals steer claims related to damaged property, including vehicles. These lawyers understand the intricacies of insurance policies and can assist you in getting the compensation you deserve.

Personal injury lawyers may also handle property damage claims if the damage is part of a broader personal injury case. They can help ensure that both your personal injury and property damage claims are addressed together, simplifying the process.

How do I sue for car damage?

Suing for car damage involves several key steps. First, gather all evidence related to the damage. This includes photos of the damage, repair estimates, and any police or accident reports.

Next, consult with a vehicle property damage lawyer. They can help you understand whether a lawsuit is necessary or if a settlement can be reached with the insurance company. If a lawsuit is the best option, your lawyer will guide you through the legal action process.

During legal proceedings, the goal is to reach a settlement that fairly compensates you for your damages. This might involve negotiations with the other party’s insurance company or, if necessary, presenting your case in court.

What are the insurance company’s obligations?

Insurance companies have several obligations when handling property damage claims. They must process claims timely, ensuring that you receive a quick response and resolution.

Fair representation is another critical obligation. Insurance companies should evaluate claims based on the evidence provided, without bias or unfair practices.

Finally, insurance companies are responsible for providing a claim payout that accurately reflects the damage sustained. If you feel your claim has been undervalued or unfairly denied, a property damage lawyer can help challenge the insurer’s decision and advocate for a fair outcome.

Contact EC Law Counsel For Help With Your Property Damage Claims

Navigating the complexities of insurance claims can be daunting, especially when dealing with vehicle property damage. That’s where EC Law Counsel steps in to make a difference. With their deep understanding of the property insurance industry, they are uniquely positioned to help you recover the settlement you deserve.

Their team, composed of former insurance adjusters and underwriters, knows the ins and outs of the claims process. This experience allows them to avoid unnecessary delays and tackle any problems that insurance companies might throw their way. They are committed to ensuring that your claim is processed efficiently and fairly.

When it comes to settlement recovery, having a knowledgeable partner can make all the difference. EC Law Counsel works tirelessly to ensure that every aspect of your claim is considered and that you’re compensated for all your losses. Whether it’s dealing with collision damage, storm damage, or any other type of vehicle damage, they have the know-how to get results.

If you’re facing a vehicle property damage claim, don’t steer it alone. Reach out to EC Law Counsel for the support and guidance you need to secure a fair settlement. Learn more about how they can help with your property damage claim.